Brand & CX

1 May 2023

6 Min Read

Bold, Not Boring – Putting Faith Back Into Financial Services

Too many financial service institutions continue to lazily rely on heritage, even in the face of fresh, design-led challengers like Monzo. Gone are the days when tradition bred automatic trust; now replaced by savvy citizens who want experience and service that resonates. Let’s talk how.

Aristotle — one of philosophy’s big dogs back in the day — believed wealth was the considered accumulation of items with purpose; or ‘telos’ in Ancient Greek.

Specifically, he used the term to describe the final cause of an entity or art as nothing could be understood without knowing what that ‘end point’ was. For material objects, telos is easily understood as its function: a book is to be read, a bed is to be slept in and a bottle is to be drunk.

Unfortunately for student-turned-master of Ancient philosophy (and us), the concepts of purpose, function and wealth seem to have become far more complex a few thousand years later.

Amid continually disrupted growth thanks to the wars in Ukraine and Gaza, a cost-of-living crisis and regional constrictions, even the high-net-worth are feeling the squeeze and the purchasing of high-ticket items is now down to far more than functional purpose. These decisions are driven by perceived value and investment.

Phrases like ‘money anxiety’ and ‘money trauma’ are now firmly set in the vernacular, this year especially, yet the subject of personal finance is still explicitly taboo. It’s an irony that’s stunted traditional financial service institutions (FSIs) and cracked open a chasm for new challengers to climb.

People Over Paper

Trust levels between people and financial institutions have unsurprisingly declined due to the economic turmoil that’s plagued the past few years. Even outside of the collective circumstantial risks, we’ve all heard countless, nightmare-inducing stories of scams.

Trust isn’t a new need. It’s always existed at the core of the finance world and should be table stakes by this point — a hygiene factor in an increasingly saturated economy.

Just like every other sector affected by meta-shifts, finance is transforming rapidly. Where interaction and experience used to orbit around local branches and in-person service, digital as default has ushered in renewed consumer focus on independence, ownership and status — three elements inextricably linked to brand love and trust, especially when it comes to financial services.

As traditional barriers to entry drop and access to investment becomes democratised, FSIs must innovate humanly while continuing to keep up with technological advancements. They must be radical in what has historically been a painfully stayed sector. Shake off the ‘boring’ misnomer of a misunderstood industry and acknowledge the fact that a new kind of customer is emerging — one who wants to align with brands that give a shit.

Four Fundamentals of Financial Services for the Modern Citizen

Bold Design & Digitisation

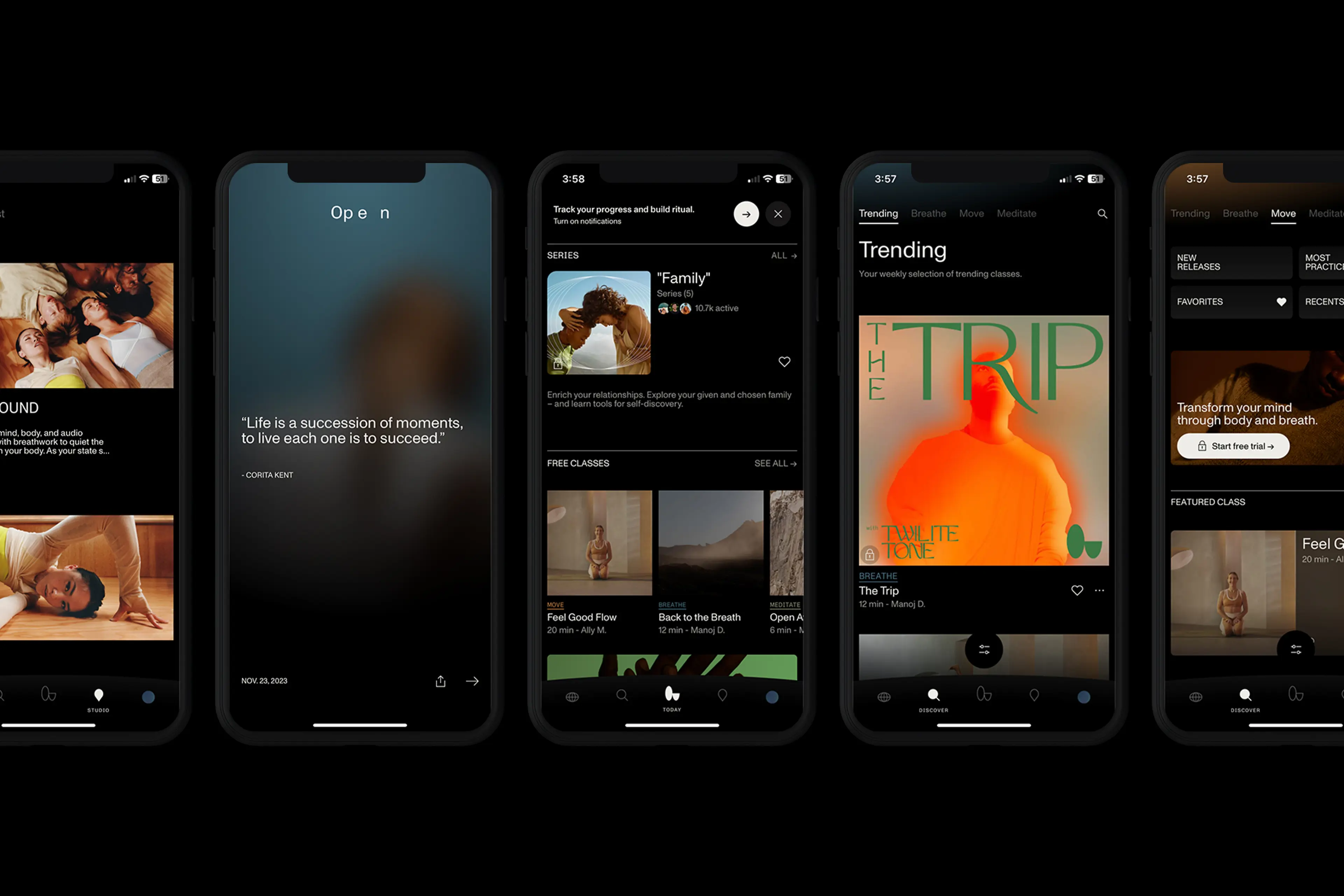

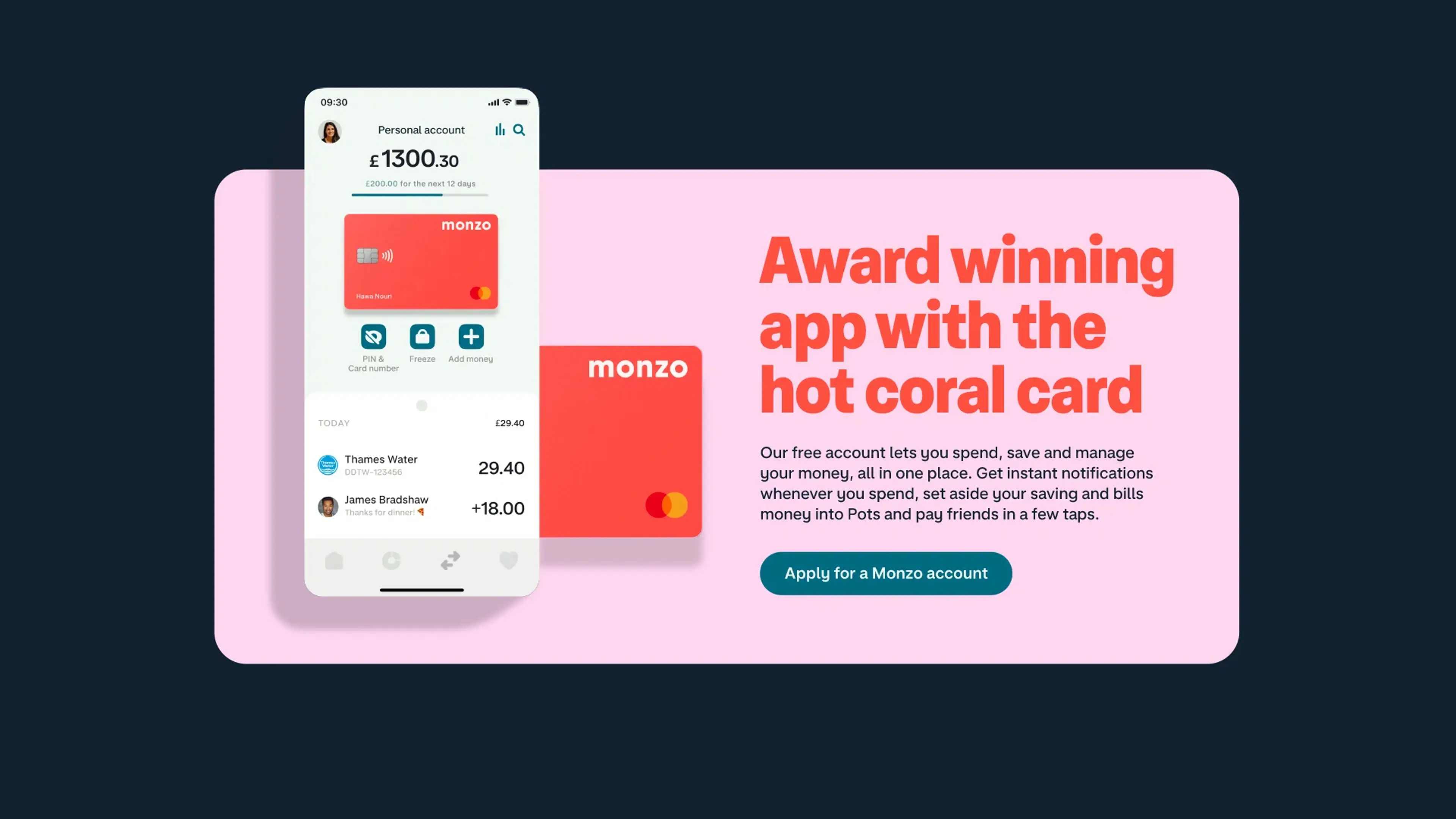

Let’s start with the ultimate challenger brand; the neon coral card that changed the game.

In 2015, Monzo was a plucky mobile-first startup asking ambitious investors to take a chance on a new way of banking. In 2024, they’re the antithesis of dormant bank brands; adversaries in a complacent category with approximately seven million cardholders worldwide — those bright pieces of plastic holding prime real estate in the wallets of city-slickers everywhere. It’s a challenge to avoid spotting one being whipped out at the London Underground barriers.

Their success sprung from their (seemingly) simple mission: to bring solutions to daily challenges — making “money work for everyone”.

Instant push notifications may seem like the norm now but Monzo’s pioneering UX has been a draw from day one. The app shows users their transactions immediately, assigning the expense a category and an exact location on an integrated map.

The app also boasts a range of further features including the ability to freeze your card from anywhere, easily split the bill at restaurants and set budgeting goals for categories ranging from gifts and groceries to charity and savings.

In order to build the best bank in the world, Monzo were the first to realise that digital doesn’t diminish trust and that design thinking must be baked into business strategy. Plenty have followed suit, focusing on a much-needed facelift for financial services.

Galaxy describes itself as the centre of gravity for the web3 community, “uniquely positioned to help web3 projects grow and tap into traditional finance when ready”. They’re leaders in the internet’s third iteration and the crypto ecosystem, combining Silicon Valley agility with Wall Street savvy and, in turn, attracting a diverse clientele; from investors to traders to entrepreneurs to banks.

With illustrative graphic components across the end-to-end experience, Galaxy’s look and feel are elevated and exclusive without being exclusionary to finance and web3 newbies.

On the other side of the (time) coin, UK-based private bank Coutts has recently restated their relevance with a refined positioning and fresh visual identity. It’s simultaneously reflective of their extraordinary heritage and vision of their role in the future of their clients, families and finance itself.

By bringing stories and shared symbols from Coutts’ 325-year history to the foreground, their new visual identity seems like a natural expression of who they are now and who they want to be.

Also in pursuit of better selves, Tred are the “greener business account” enabling individuals to offset their carbon emissions with causes close to their heart. Tred’s app allows users to select the specific charities and organisations their investments go to with immediate real-time tracking as well as a total impact calculator.

The green brand (literally and figuratively) demonstrates their mission at every turn, placing transparency and sustainability at the core of their identity but with friendly interfaces and achievable experience.

Regardless of the design specifics and intended outcomes, finance shouldn’t be boring. And the vested interest is growing from consumers. FSIs who can bridge the chasm between creative and corporate will be ahead of the curve when consumers come to select who they want to invest in – both financially and personally.

Promoting & Aiding Financial Literacy

Even for the U/HNW, money can be messy. And finance systems and jargon can be a mystery to many. But with lower barriers to entry when it comes to investment and/or luxury spending, financial comprehension should be the rule rather than the exception. A sentiment forward-thinking FSIs are taking to heart.

Educational content is the most common strategy. Because it works. Traditionally there’s been an ‘us vs them’ mentality when it comes to people and banks — the general consensus being that clients aren’t the priority; making money is.

NYC-based Chase Bank dedicates a significant amount of content strategy to helping people understand gambling, signs of addiction and how to assist others in recognising the problem. Feature titles range from ‘getting smart about card fraud’ to ‘money lessons to teach your children’ — the latter speaking to multigenerational service.

Monzo also devotes time and character counts to educating customers with their ‘How Money Works’ blog as well as offering an optional gambling block tool to act as an aid for those who need it.

Swiss private bank Bergos also invests some serious resources in the development of their clientele’s collective education — they’re not the most traditional of private banks. Their design (visuals and UX) is fresh and bold, alive and unfurling to draw prospective customers into the experience. A far cry from the Halifax Banks and HSBCs of the world.

It’s unsurprising then that they also use a fresher medium to transfer knowledge to their audience: podcasts. Simply titled ‘Bergos ED’, the series sheds light on fundamental concepts of financial markets, from the basics of banks and asset classes to a who’s who in finance and a how-to on investing with style.

Financial illiteracy is rampant. Even among the U/HNW. It’s why wealth managers and advisory firms exist. But in a moment of “fake news” and a hundred different X–gate scandals, prioritising your clientele’s knowledge will lead to long-term success.

Community & Connection

As niche and tight communities continue to flourish — entry driven by purchasing decisions and brand alignment — a scaled sense of belonging could heal collective anxiety surrounding finance and rapidly build loyalty.

Just as Londoners love a Monzo card, British neobank Revolut has become the hallmark of travellers, offering one of the best exchange rates for weekday spending.

Rated ‘Excellent’ on Trustpilot with a score of 4.3/5.0, the digital banking alternative has a cultural reputation as the brand for globetrotters everywhere. They’re synonymous with travel, especially uniting younger individuals who want to see the world.

By tapping into that incessant urge to explore, the community they’ve built has caught like wildfire — even catalysing a very lengthy Reddit thread that reads as Revolut scripture.

Wise — a UK-based foreign exchange fintech company — is for “people going places” and manages to simultaneously appeal to the international market while fostering community among both current users and target audiences.

Founded in 2011 out of founders Taavet Hinrikus and Kristo Käärmann’s frustration with international bank transfers complete with hidden charges and high fees, over 16 million people have joined Wise; many of them expats, international students or migrant workers and their families.

The fintech company partnered with branding agency Ragged Edge on a rebrand in March 2023, which not only took the design community by storm but their entire user base.

Rationalising the decision, their website reads:

“Wise works in 170 countries. You can send, spend and receive like a local almost everywhere. For us this meant being local, on a global scale. Responding to the countries and cultures we serve, not just reflecting them.

Since the start of Wise, we have driven irreversible change in an outdated industry and shone a light on hidden fees. So step one was to regain this challenger spirit. Creating a brand that is deliberately different.”

Increasingly in our world, daily decisions are incremental additions to our self-expression. Including who we bank with. So whether someone resonates the most with being a challenger, traveller, innovator or something completely different, FSIs have to tap into identity. Because decent interest rates alone won’t cut it when it comes to loyalty.

Collaboration

Why should fashion have all the fun when it comes to collaboration? More often than not, partnering with like-minded businesses or fellow advocates for a cause is a rapidly effective way to build that all-important community. Especially if that cause is celebratory — a collective belief that life is to be enjoyed and money is best spent on enriching moments and memories.

American Express (AMEX colloquially) bank on providing top-tier experiences for their client base, ranging from exclusive access to city lounges across the world and complimentary tickets and tours to pre-sale access to every event you can likely think of and multiple perks for guests on the day. At London’s Field Day Festival in 2022, all AMEX account holders received a free reusable water bottle on entry and that simple, convenient treat must’ve doubled their existing loyalty among those people and boosted awareness tenfold.

Mastercard do similar things in the sport, art and entertainment spaces; offering sponsorship to venues, event organisers and so on. And while they, alongside brands like Visa, have decided to suspend the launch of crypto-related services until the market has stabilised, crypto-industry leaders are leaning into the air of collaboration taking hold currently.

One of the most high-profile partnerships was between Premier League club Manchester United and open-source blockchain Tezos, one of the most advanced and sustainable versions of the technology.

An original proof-of-stake blockchain, Tezos was built with an energy-efficient design that allows it to operate in a cleaner and more environmentally friendly way than other blockchains.

Their multiyear contract with the club includes their appointment as an official training kit partner with the ultimate objective to introduce Man U fans to Web3 via the Tezos blockchain. Off the back of the partnership, MUFC’s inaugural NFT collection was gifted to fans via a Tezos platform in November 2022.

The best crypto collab by far was between UkraineDAO’s launch of a 1/1 NFT, minted by CXIP, of the Ukrainian flag to raise funds for the country’s defence. It ran for 72 hours after which 100% of proceeds went directly to the “Come Back Alive” fund. Overall, 3,200 people made bids — ranging from 0.00001 ETH (less than 3 cents) to 44 ETH ($128,000).

---

All of these pillars are indicative of FSIs prioritising people and humanity. Of course, they’re still in the business of making money but there are examples of a healthy balance. Incorporating all four will not only boost your business but create a self-sustaining symbiotic relationship across the board. And although enhancing humanity with tech may seem like a daunting prospect, not doing so will guarantee erasability in the minds of savvy consumers. And in 2023, that’s essentially all of them.

Whether it’s through bold branding, brave design, innovative CX or all three, we specialise in helping brands be the exact opposite of boring. Get in touch with one of our consultants via [email protected] to find out more about our services.

Brand & CX

Tech & Innovation

Design